Hsmb Advisory Llc Fundamentals Explained

Table of ContentsThe Basic Principles Of Hsmb Advisory Llc The Facts About Hsmb Advisory Llc UncoveredThe 6-Second Trick For Hsmb Advisory Llc6 Simple Techniques For Hsmb Advisory LlcHsmb Advisory Llc Fundamentals ExplainedSome Known Details About Hsmb Advisory Llc

If the plan proprietor is under 59, any taxable withdrawal might likewise undergo a 10% federal tax fine. Motorcyclists may sustain an extra price or costs. Motorcyclists may not be readily available in all states. All whole life insurance plan guarantees undergo the timely payment of all required premiums and the cases paying ability of the providing insurance provider.

The money surrender value, loan worth and fatality profits payable will certainly be lowered by any lien superior because of the repayment of an accelerated benefit under this motorcyclist. The sped up benefits in the first year show reduction of a single $250 management charge, indexed at a rising cost of living rate of 3% per year to the rate of acceleration.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

A Waiver of Premium rider forgoes the responsibility for the policyholder to pay further costs should he or she become totally impaired constantly for a minimum of six months. This motorcyclist will certainly sustain an additional price. See policy contract for additional information and needs.

Here are several disadvantages of life insurance policy: One drawback of life insurance policy is that the older you are, the much more you'll spend for a plan. This is because you're most likely to die throughout the policy duration than a more youthful insurance policy holder and will, subsequently, cost the life insurance policy firm more cash.

While this might be a plus, there's no assurance of high returns. 2 If you choose a permanent life plan, such as whole life insurance policy or variable life insurance policy, you'll receive long-lasting protection. The caution, nevertheless, is that your premiums will be higher. 2 If you want life insurance coverage, consider these pointers:3 Don't wait to obtain a life insurance plan.

Some Known Questions About Hsmb Advisory Llc.

By using for life insurance policy coverage, you'll be able to aid protect your enjoyed ones and obtain some tranquility of mind. If you're not sure of what type of protection you ought to get, get in touch with an agent to discuss your alternatives.

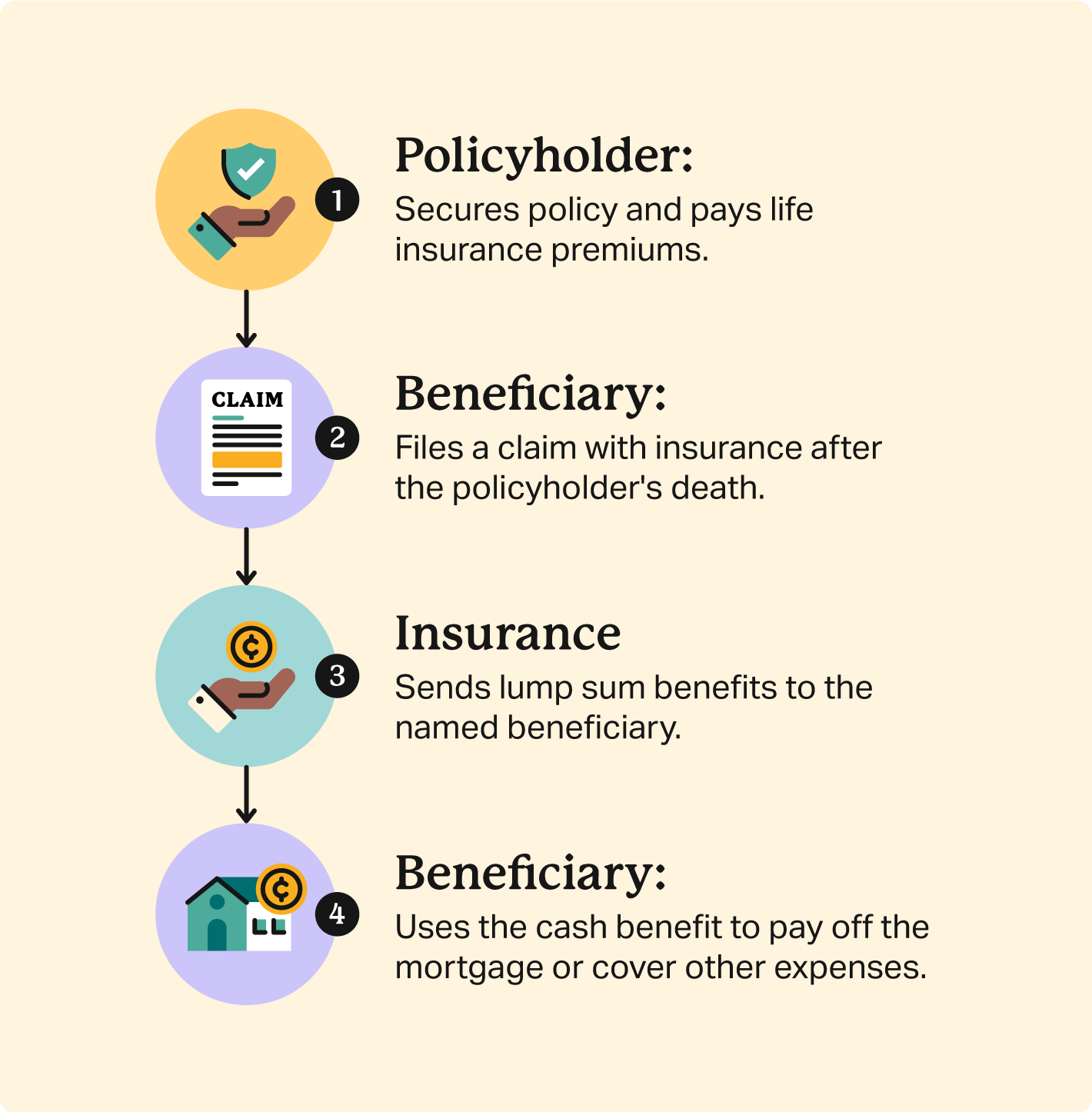

There are many potential advantages of life insurance yet it's generally the confidence it can give that matters the a lot of - https://padlet.com/hunterblack33701/hsmb-advisory-llc-p8g71htvekum37of. This is since a payout from life cover can function as a financial safeguard for your enjoyed ones to fall back on should you pass away while your policy remains in place

But the bypassing benefit to all is that it can take away at the very least one concern from those you appreciate at a challenging time. Life insurance policy can be established up to cover a home loan, potentially assisting your family members to stay in their home if you were to die. A payment can aid your dependants replace any earnings shortage really felt by the loss of your earnings.

The Ultimate Guide To Hsmb Advisory Llc

Life cover can aid minimize if you have little in the method of cost savings. Life insurance items can be utilized as part of inheritance tax obligation preparation in order to minimize or prevent this tax.

You're hopefully taking away a few of the stress and anxiety felt by those you leave behind. You have peace of mind that enjoyed ones have a particular level of financial defense to draw on. Securing life insurance policy to cover your mortgage can give comfort your mortgage will certainly be settled, and your loved ones can proceed living where they've constantly lived, if you were to die.

The 7-Second Trick For Hsmb Advisory Llc

Superior debts are normally repaid using the worth of an estate, so if a life insurance policy payment can cover what you owe, there ought to be a lot more entrusted to pass on as an inheritance. According to Sunlife, the typical expense of a standard funeral in the UK in 2021 was just over 4,000.

Hsmb Advisory Llc Can Be Fun For Anyone

It's a substantial amount of cash, yet one which you can offer your enjoyed ones the possibility to cover making use of a life insurance policy payment. You need to examine with your provider on details of just how and when payments are made to make sure the funds can be accessed in time to spend for a funeral service.

It may also give you extra control over that obtains the payment, and assist reduce blog here the chance that the funds can be made use of to repay financial debts, as can occur if the policy was outside of a trust fund. Some life insurance policy policies include an incurable ailment benefit option at no added expense, which might result in your plan paying early if you're identified as terminally ill.

A very early repayment can allow you the possibility to get your events in order and to make the many of the time you have actually left. Losing someone you love is tough sufficient to deal with by itself. If you can assist ease any fears that those you leave behind could have regarding how they'll deal financially relocating forward, they can concentrate on things that really must matter at one of the most difficult of times.